Every investor is different, coming to the table with a different amount of capital, a different risk tolerance, a different lifestyle and different vision for their investment outcome. To me, that’s the magic of finding ways to achieve financial independence – you can create your ultimate lifestyle in a way that suits the current one.

This is important because there are pros and cons of different asset classes and not every one of them will suit every person in the same way.

For example, coughing up huge upfront chunks of cash to finance a property deposit isn’t realistic for those where their savings rate simply cannot exceed the rate of property inflation.

On the other hand, the short-term volatility of shares may make others too anxious, working to turn investing into a negative experience for their mental health, instead of an empowering and exciting one.

For those with an earlier retirement springboard than most, maxing out the tax-friendly enclave of their superannuation account is pretty silly if they can’t touch it until they’re 60. Others just have no interest in bonds, trusts and other lower-profile types of investments, and no keenness to manage them either.

The sweet spot really is to look at your lifestyle and how much you can afford to funnel in. Be honest in how hands-on you want to be in managing any investments and finally, find a healthy calibration between your risk tolerance and your timeframe to financial freedom.

The general rule of thumb is that longer timeframes can afford to withstand more short-term volatility – in exchange for higher growth – and shorter ones may benefit from more conservative (but lower return) investments.

When you match your lifestyle to your goals, you’ll find an ideal investment structure that helps you to stay committed for the long-haul, and a committed investor is a successful one, no matter what happens in the market.

Here’s a summary of the most common investments that can help you to achieve financial independence, and the pros and cons of each.

Property and real estate.

While houses, townhouses, units and acreage may seem more tangible than other types of investments – as in, you can actually touch the foundation, open the door and look out of the window – they’re definitely a hands-on investment vehicle.

I have a love-hate relationship with investment property, because there have been times where renting out mine feels like way more hassle than it’s worth.

In a renters market, where supply is rife and renters have ample choice, it can be hard to find tenants at all, and when you do, they’ll be in a strong position to negotiate down their rate, or specify exit terms unfavourable to you – like ending their lease with little notice and no penalties.

Likewise, if you get a tenant who doesn’t take good care of your property, breaches the terms of their agreement or defaults of their rent, it can be an expensive exercise even with landlords insurance (which is highly recommended, but yet another cost).

Ultimately, I believe that people always need somewhere to live (and as property investors, we have an ethical investing duty to ensure safe and affordable housing), but the holding costs of property do need to be considered.

Pros:

- It’s simple. Getting your head around the purchase of a property is fairly straightforward. In many cases, the most stressful part of it is finding the right place, and either having your offer accepted or lifting your paddle at the auction.

- As returns go, property errs on the side of stability. Property, particularly in Australia where I live, does well. Research supports that the last three decades of housing inflation has been extremely profitable for homeowners and property investors (a 412% average increase, in fact) and this equates to strong capital growth (your property rising in value) and solid return (rental yield) in a stable, high-demand market.

- Property offers a lot of tax deduction opportunities thanks to our federal governments obsession with real estate. Not only can you offset most expenses against the income derived from rent – including loan interest – but all acquisition, sales and maintenance costs can be added to what’s known as your ‘cost base’, which is the liability you have for capital gains tax if you sell. If you operate at a loss, this can potentially wipe out your CGT liability completely, and even carry over to offset future gains from other investments, which isn’t restricted to only property. In short, history shows your investment will pay off, but even if it doesn’t, the hit will be minimised.

Cons:

- Cost, because it can – and very well may be – a sinkhole at times. Although your losses can be minimised if you meet certain conditions, there are high entry and exit costs to real estate which go beyond the cash deposit. Stamp duty, legal fees, the agents fees, lenders mortgage insurance, landlords insurance… it all adds up. You have a bad tenant? Have to make regular repairs? In cases where insurance doesn’t cover you, that will come out of your pocket. You can’t find a tenant for a few months, or longer? The mortgage still needs to be paid. If reserve interest rates rise and the rental market hasn’t caught up enough to help shoulder that cost, you’re eating more and more into your income to cover the difference.

- Property is the opposite of liquid money. If you need cash quickly, selling in a hurry isn’t going to be easy, or fun, and the tax and fees you’ll pay will eat into your profit even if you do. If the housing market is going through a rough patch, you’ll feel it at the sale price, and it’ll sting.

Company and fund shares.

Otherwise known as private equity, buying shares is buying a portion of a business (or many businesses) and taking your fair slice of any profits created.

For dividend investors, which is a very common form of long-term financial independence investing, that profit is delivered as a payment to your bank account many times a year, and eventually replaces your income from a traditional job.

While I love shares and they’re my favourite type of investment, I realise that they can seem intimidating. If you’ve ever cast an eye over the trading floor of a virtual stock exchange, or heard the newsreader talk about the performance of the S&P500 or the Dow Jones in their nightly report, for a newbie, it does all look and sound like gibberish – I get it. But practice makes perfect and it can be a lot of fun if it’s the right investment type for you.

My husband and I invest in a share portfolio that is broadly diversified like this:

-

40% global exchange traded-funds and listed investment companies (exc. AU)

-

20% ethical and prospecting exchange-traded funds and listed companies

-

20% US exchange-traded funds and listed investment companies

-

10% Australian exchange-traded funds and listed investment companies

-

10% emerging market exchange-traded funds and listed investment companies

This is a pool that represents the best mix for our risk appetite, which is moderate to high.

We have a good base of local and international picks, a decent chunk of ethical holdings – which we believe is important and where we’ll see a lot of technology and investment go – as well as new markets, which is a speculative bet for us based on what countries we think will experience a resource, technology or economic boom.

In addition to this, we use cash boosts to short stocks, which is where we’re “borrowing” stock, betting the share price will fall before selling it back. We call this our ‘Black Swan’ portion, but full disclosure, it’s certainly not a strategy a new investor would use. Let’s take a look at some of the clear pros and cons of shares generally.

Pros:

- It’s so easy to start buying shares. The upfront investment is minimal in comparison to other types of investments, like property, and online brokerage is cheap with competitive fees. You could take $1,000 right now and by the end of the trading day, own part of a business with an investment that’s now working to use your money to make you more. Rinse and repeat that enough times and you’ve got yourself an income you’re earning poolside.

- If you need to sell your shares, theoretically the trade could all be finalised within two days and the effort on your part is minimal. I’m simplifying it and not touching on the tax and fee component, but you get my drift. It’s not a labour-intensive task and can get cash in your bank account quickly.

Cons:

- You do need to have a basic understanding of how to buy, sell and understand shares. Not a comprehensive understanding – this comes with time and practice – but you want to have done some research on what fund or company you’re investing in, why, and what to expect in terms of holding time and returns. Signing up to a free online brokerage and taking a look at the terms you see in front of you can be helpful. When I started all those years ago, I went to talks and seminars, signed up for online courses, and very, very frequently took terms like ‘close price, ask/offer, growth stock, mid-cap’ and literally pasted into Google “what is <thing>” or “video example of <thing>”. Yeah, and people herald me now for being an investing whiz. That is literally how I started.

- You can lose money. Not that you can’t in any other type of investment, of course, but the sharemarket typically experiences a lot more short-term volatility, with sometimes multiple price fluctuations in a single day. Given that share price is a direct result of market sentiment, even a slightly controversial news article can have your holdings plummeting. For many investors, diversification helps to cushion your portfolio against individual stock drops and history shows that in many cases, such events are not a concern for long-term performance. It’s never a guarantee, but I personally don’t lose sleep over it.

Fixed interest.

Fixed interest investment vehicles cover things like bonds, term deposits, mortgage offset accounts and even high-interest savings accounts.

It’s not a bad idea to have a bit of diversification if this investment type suits you, and the peace of mind that comes from having access to money in a relatively low-risk and simple environment can be reassuring.

Bear in mind, though, that your return is going to reflect the risk.

Pros:

- Fixed interest investments are good places to start making your money work for you while you learn how to invest. Additionally, they can be helpful if you have a hefty mortgage that you can offset the interest on (particularly handy when reserve interest rates are inherently high), or if you have a clear plan for your child to attend a tertiary education provider and want to make the investment upfront.

Cons:

- For certain bonds, you’ll need to meet the conditions of the bond before the money or benefit can be released.

- The returns are low and if your money is principally tied up in structures like this, you risk them not exceeding the cost of inflation which can actually lose you money.

Superannuation.

If you have a superannuation fund with money in it, you’re an investor. You’re invested into a diversified portfolio of growth and defensive stocks across various industries and that is working for you to ensure your retirement income.

How you choose your asset allocation and how much you invest in will determine how much sits in the overall pot. I love having a superannuation account and see it as another very strong investment pillar in my overall plan, but I also harbour concerns that it’s a relatively new concept and may become outdated. I like how the tax-effectiveness of it works for me as I earn an income to build wealth, but I also know that the fees earned are higher than I am charged in some share investments, so if super wasn’t so tax-effective, I’d move the balance elsewhere.

Pros:

- If you’re in normal employment, your employer likely has to pay into it by law, so it’s an investment vehicle that’s accruing with you having to do much at all.

- Superannuation is very tax-effective, with an amount of non-concessional contributions allowed per year taxed at a very appealing rate (15%). In many cases, this is well below the marginal tax rate you’d otherwise be hit with if you kept it as income.

Cons:

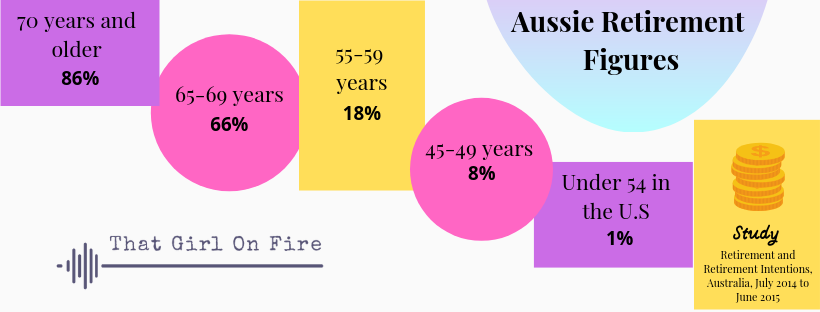

- In many cases (and depending on your age bracket), you won’t be able to touch it until 60, so if you want to retire early, you’ll need to create passive income from other sources to bridge the gap between your retirement age and your preservation age. You’ll also need to consider the fee implications of not contributing to the fund if you retire before 60, because fees can eat away a significant chunk of the principal amount. By that stage, compounding interest should be doing some very powerful work but it’s always good to be aware of any forces that can impact the funds value (and this includes having it in the wrong risk allocation for your age and needs).